By Courtney Rozen

As D.C.’s annual tax filing deadline approaches, Mayor Muriel Bowser is encouraging families to take advantage of a new tax credit for child care, which she proposed making permanent in her State of the District address in March.

The Early Learning Tax Credit, a dollar-for-dollar tax credit capped at $1,000, will be an option this tax season for families with children under age 4 who pay for child care licensed by the district, said Andrew Reiter, assistant general council for the D.C. Office of Tax and Revenue. This is the first time the district has offered this one-time tax credit, he said.

The credit aims to alleviate the cost of child care in the district. D.C. is ranked first out of 50 states and D.C. for most expensive infant care, with the average cost being $22,631 per child, according to the Economic Policy Institute, a think tank that studies the needs of low- and middle-income workers. A minimum-wage worker in D.C. would need to work full time for 54 weeks to pay for child care for one infant, according to EPI.

For families that pay for traditional day care, the credit won’t offset most of the cost of child care. The Early Learning Tax Credit also won’t help families who use informal day care arrangements or receive subsidies to pay for child care. That means most low-income families won’t be eligible for the tax credit, said Teresa Hinze, executive director of Community Tax Aid, a group that serves taxpayers with a family income of less than $55,000 per year.

But, D.C. already offers partial or full child care subsidies based on family size, number of children in care and income levels. Right now, for example, a family of four making $62,750 or below qualifies for a subsidy (that adds up for 250% of the federal poverty level of $25,100), according to the Office of the State Superintendent of Education.

“I’m thankful for it, it doesn’t offset the full cost of having a kid in the district,” said Deanwood resident Sophie Murphy, a single mom who sent her son to day care before he started public preschool this school year. “You’re always thankful for any help that they offer.”

Reiter, who worked on the legal aspects of the credit in the Office of Tax and Revenue, said it’s not designed to defray the entire cost of child care. It also purposefully doesn’t apply to families with children who are older than age 4, Reiter said, because the district offers public preschool for them. D.C. has offered public preschool for 3- and 4-year-olds since 2009. D.C. also participates in a federally-funded child care subsidy program, which provides vouchers to help low-income families pay for care.

Day cares must also be licensed by D.C. for families to receive the credit, and the Office of the State Superintendent of Education has a list to check if a day care is eligible. Reiter’s team won’t know which income groups took advantage of the credit until after tax filing season ends in April, he said.

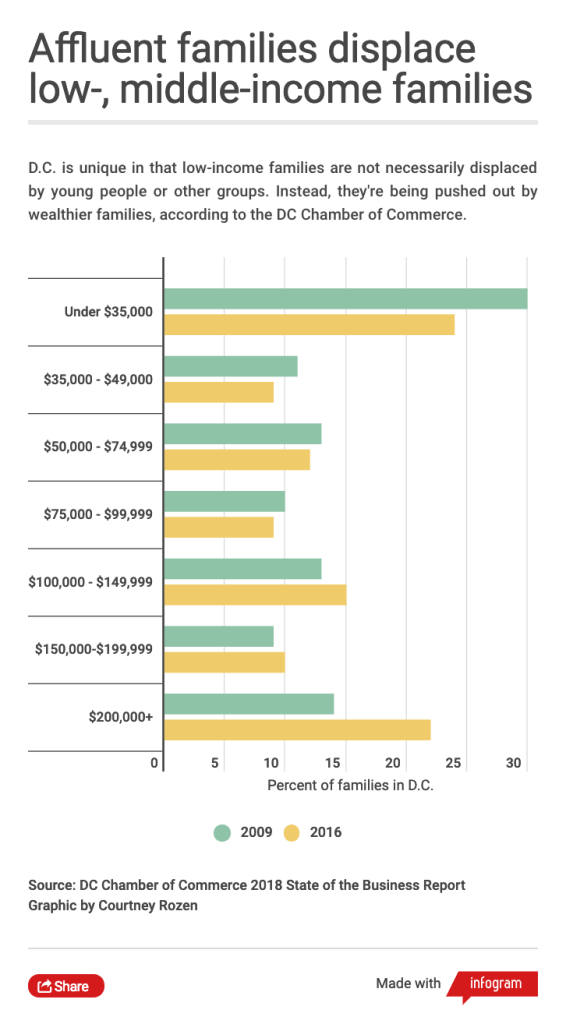

Vincent Orange, the president of the DC Chamber of Commerce, said he supports the Early Learning Tax Credit because it adds support for families living in D.C. However, he said affluent families are now displacing low- and middle-income families, and the city council and mayor need to focus on the cost of housing and the quality of public education if they want to support them.

The Chamber defines low-income families as those who earn less than $35,000 per year. They define middle-income as those who earn less than $100,000 per year, respectively. Together, low- and middle-income families now make up 52% of all families in D.C., compared to 64% 10 years ago, according to a report released by the Chamber in 2018. 22% of D.C. families in 2018 earned more than $200,000 per year. He sees this displacement as a priority for D.C.’s business community, who relies on workers of different income levels to keep companies operating.

Orange said the D.C. government has a responsibility to use tax dollars to “provide pathways to a good quality of life” for low-income residents.

“You cannot have a city of the have and have nots,” Orange said.